By Millie Robinson June 10, 2025

Right POS System: In the dynamic landscape of modern commerce, the tools you use can either propel your business forward or hold it back. At the heart of daily operations lies a critical piece of technology: the Point of Sale (POS) system. Gone are the days of the simple, clunky cash register. Today’s POS systems are sophisticated command centers that handle far more than just transactions. They are the nexus of sales, inventory, customer data, and analytics. This makes choosing the right POS system one of the most impactful decisions a business owner can make.

The perfect system streamlines operations, provides invaluable insights into your business’s health, and enhances the customer experience from start to finish. Conversely, the wrong system can create operational bottlenecks, frustrate staff, and lead to missed opportunities for growth. The journey to find the right POS system can feel daunting with the sheer number of options available, each promising to be the ultimate solution.

This comprehensive guide is designed to demystify the process. We will walk you through every key consideration, from understanding your unique business needs to evaluating core features, hardware, software, and crucial integrations. Our goal is to empower you with the knowledge to select a solution that not only meets your current demands but also scales with your ambitions. Investing time in finding the right POS system is not an expense; it’s a strategic investment in your business’s future success.

What is a POS System and Why is Choosing the Right One Crucial?

A Point of Sale (POS) system is the combination of hardware and software that enables your business to accept payments and manage sales. While its most basic function is to ring up customers, a modern POS does so much more. It acts as a central hub, tracking sales data, managing inventory levels, building customer profiles, and generating insightful reports. The evolution from a cash drawer to a multi-faceted management tool underscores its importance.

The impact of selecting the right POS system reverberates through every aspect of your business. It directly affects your operational efficiency. A system with an intuitive interface reduces training time for new employees and minimizes costly errors during checkout. Speedy and seamless transactions lead to shorter lines and happier customers, which in turn boosts loyalty and encourages repeat business.

Furthermore, the data collected by the right POS system is a goldmine of business intelligence. It can tell you which products are your bestsellers, what times of day are your busiest, and who your most valuable customers are. This information allows you to make data-driven decisions about purchasing, marketing, and staffing, moving your strategy from guesswork to a precise, informed approach. Making an effort to find the right POS system is therefore a foundational step towards building a resilient and profitable enterprise.

Understanding Your Business Needs: The First Step to the Right POS System

Before you can even begin to compare different POS solutions, you must first look inward. The single most important factor in this decision-making process is a deep and honest understanding of your own business’s specific requirements. A POS system that is perfect for a bustling restaurant will likely be a poor fit for a boutique clothing store. The quest for the right POS system begins with a thorough self-assessment.

Analyzing Your Industry Type (Retail, Restaurant, Service, etc.)

Different industries have vastly different operational workflows, and your POS system must be tailored to support them. A one-size-fits-all solution rarely provides the depth of functionality needed for specialized businesses.

- Retail Businesses: For a retail environment, the right POS system needs robust inventory management capabilities. Key features include barcode scanning, the ability to handle product variations (like size and color), stock level tracking across multiple locations, purchase order creation, and seamless management of returns and exchanges. Loyalty programs and gift card support are also vital.

- Restaurants and Food Service: The hospitality industry requires a unique set of tools. The right POS system for a restaurant will include table management and layout mapping, the ability to split bills and modify orders easily, and integration with kitchen display systems (KDS) or printers to streamline communication between the front and back of the house. Features for managing tips, reservations, and online ordering are also essential.

- Service-Based Businesses: Salons, spas, and repair shops have a different focus. For them, the right POS system prioritizes appointment scheduling and calendar management. It should also include robust client relationship management (CRM) features to track client history, preferences, and notes. The ability to handle recurring billing, deposits, and package deals is a significant advantage.

Assessing Your Business Size and Scalability

Your current business size is a key factor, but your future ambitions are just as important. The right POS system should not only serve you today but also have the capacity to grow alongside your business.

A single-location small business may only need one or two terminals and a basic feature set. However, if you plan to open more locations, expand into e-commerce, or add a new service, you need a system that can scale effortlessly. A cloud-based system often provides this flexibility, allowing you to add new terminals, locations, and users with ease. Choosing a system that cannot grow with you will force a costly and disruptive migration down the line. Therefore, thinking about scalability is crucial when searching for the right POS system.

Defining Your Budget: Initial Costs vs. Long-Term Value

Budget is always a primary concern, but it’s vital to look beyond the initial price tag. The total cost of ownership (TCO) gives a more accurate picture of the investment. When evaluating the cost, consider the following components:

- Upfront Hardware Costs: This includes terminals, cash drawers, receipt printers, barcode scanners, and payment readers. Some providers offer hardware bundles, while others allow you to use your own compatible devices like iPads.

- Monthly Software Fees: Most modern POS systems operate on a subscription-as-a-service (SaaS) model, charging a recurring monthly or annual fee. This fee often varies based on the number of terminals, locations, and the feature tier you select.

- Payment Processing Fees: This is how the POS company and payment processors make money from your transactions. These fees can be complex, so understanding the pricing model (e.g., flat rate vs. interchange-plus) is crucial.

- Hidden Costs: Be sure to ask about any additional fees for setup, training, premium customer support, or specific integrations.

A cheaper system might seem appealing initially, but if it lacks essential features or has exorbitant payment processing fees, it is not the right POS system for long-term success. Focus on the value the system provides and its potential return on investment.

Core POS Features You Absolutely Cannot Ignore

Once you have a clear picture of your business needs, the next step is to evaluate the core features of potential POS systems. While some functionalities are industry-specific, there is a set of foundational features that are non-negotiable for almost any modern business. These tools are what elevate a POS from a simple payment processor to a powerful business management solution. The right POS system will excel in these key areas.

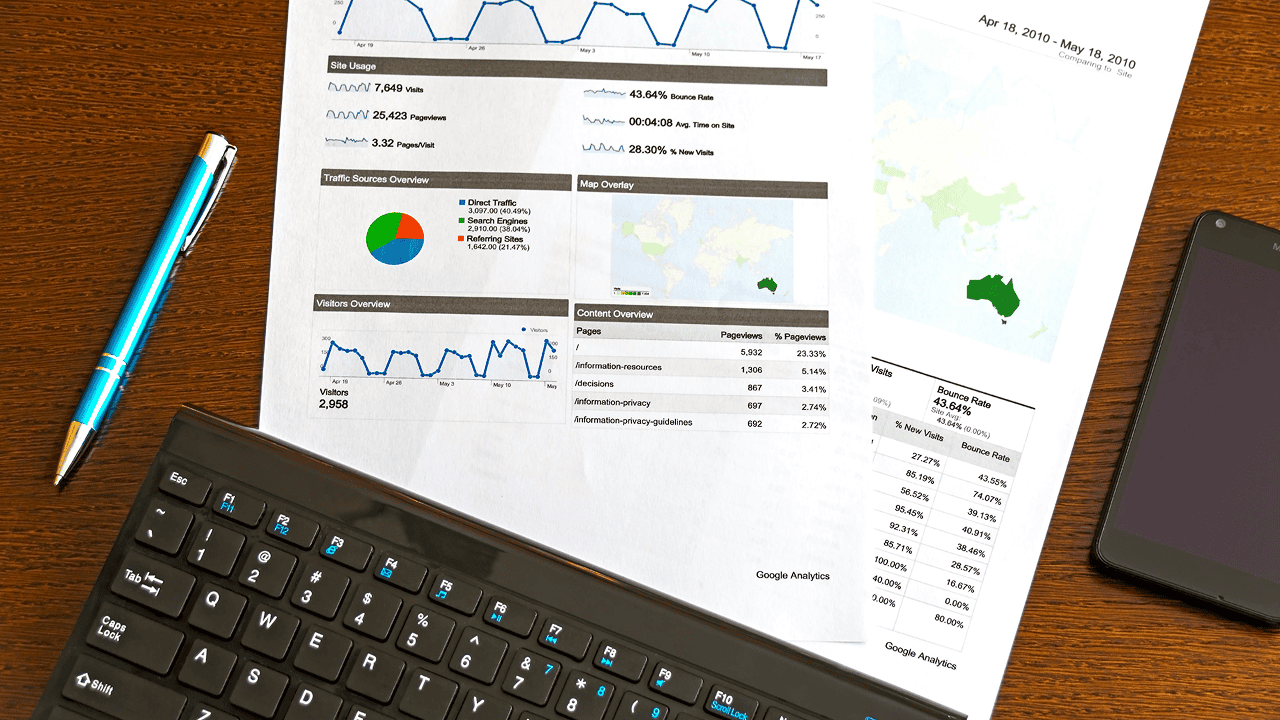

Sales Reporting and Analytics

Data is one of the most valuable assets your business possesses. The right POS system acts as your primary data collection tool, and its reporting and analytics capabilities are paramount. Vague, high-level reports are no longer sufficient. You need access to granular, real-time data that you can use to make strategic decisions.

Look for a system that provides:

- Real-time sales dashboards: A quick overview of your business’s performance at any given moment.

- Product performance reports: Identify your best-selling and worst-selling items to optimize purchasing and promotions.

- Sales trend analysis: Understand your busiest days and hours to optimize staffing levels and marketing campaigns.

- Employee performance metrics: Track sales per employee to identify top performers and areas for training.

- Customer purchase history: Gain insights into customer behavior to personalize marketing and improve retention.

A data-driven approach is essential for growth, and a powerful analytics suite is a hallmark of the right POS system.

Inventory Management

For any business that sells physical products, effective inventory management is the backbone of profitability. Poor control leads to stockouts, which result in lost sales and unhappy customers, or overstocking, which ties up valuable capital in unsold goods. A POS system with integrated inventory management automates and simplifies this critical process.

Essential inventory features in the right POS system include:

- Real-time stock tracking: Automatically deducts items from inventory counts as they are sold.

- Low-stock alerts: Notifies you when an item’s quantity falls below a pre-set threshold, so you can reorder in time.

- Purchase order management: Allows you to create, send, and track purchase orders to your suppliers directly from the POS.

- Supplier database: A centralized place to manage supplier information and track ordering history.

- Stock counts and variance reports: Tools to help you conduct physical inventory counts and identify discrepancies.

The right POS system transforms inventory management from a tedious manual task into an efficient, automated process that saves you time and money.

Customer Relationship Management (CRM)

In today’s competitive market, building lasting relationships with customers is key to long-term success. A POS system with built-in CRM features helps you turn one-time buyers into loyal patrons. It allows you to collect valuable customer information and use it to create personalized experiences.

Key CRM capabilities to look for when choosing the right POS system are:

- Customer profiles: Create a profile for each customer that tracks their contact information and complete purchase history.

- Loyalty programs: Easily create and manage points-based or tiered loyalty programs to reward repeat business.

- Targeted marketing: Use purchase data to segment customers and send them relevant promotions and communications via email or SMS integrations.

- Customer notes: Allow staff to add notes to customer profiles, such as preferences or special requests, to provide more personalized service.

By helping you understand and engage with your customers on a deeper level, the right POS system becomes an invaluable marketing tool.

Employee Management

Your staff is your most important resource, and your POS system can help you manage them more effectively. Integrated employee management features simplify scheduling, payroll, and performance tracking, freeing up more of your time to focus on running the business.

A right POS system with strong employee management tools will offer:

- Built-in time clock: Employees can clock in and out directly on the POS terminal, ensuring accurate time tracking for payroll.

- Role-based user permissions: Control which features and data each employee can access, protecting sensitive business information.

- Sales performance tracking: Attribute sales to specific employees to manage commissions and run performance reports.

- Shift scheduling: Some advanced systems offer tools to help you create and manage employee schedules.

These features not only improve accountability and security but also empower your team by providing clear performance metrics.

Hardware and Software: The Technical Backbone of Your POS System

A POS system is composed of two fundamental elements: the physical hardware that you and your customers interact with, and the software that runs the entire operation. Both are equally important, and the choices you make here will define your daily workflow and long-term costs. Finding the right POS system involves carefully considering how these two components align with your business environment.

Decoding POS Hardware Components

The hardware is the most visible part of your POS setup. While the specific components you need will vary, most systems are built around a core set of devices.

- POS Terminal: This is the central brain of the system. It can be a traditional all-in-one desktop unit or, more commonly today, a tablet (like an iPad or Android device) running the POS software. Mobile POS (mPOS) solutions using tablets offer greater flexibility and a smaller footprint.

- Card Reader: A device for accepting credit and debit card payments. Modern readers should be able to process EMV chip cards, NFC contactless payments (like Apple Pay), and traditional magnetic stripe swipes.

- Receipt Printer: While email and text receipts are becoming more popular, a physical printer is still essential for many businesses and customer preferences.

- Barcode Scanner: A must-have for most retail businesses, a scanner dramatically speeds up the checkout process and reduces manual entry errors.

- Cash Drawer: A secure drawer for storing cash, which typically connects to the POS terminal and opens automatically upon a cash transaction.

The right POS system hardware configuration should match your physical space and sales process. A food truck, for example, would benefit greatly from a compact, all-in-one tablet setup, while a large grocery store may require multiple robust, stationary terminals.

On-Premise vs. Cloud-Based POS Systems

The most significant software decision you will make is choosing between an on-premise and a cloud-based system. This choice impacts everything from cost and accessibility to maintenance and security. A deep understanding of this difference is critical to selecting the right POS system.

- On-Premise POS: Often called a “legacy” or “traditional” system, this type of POS stores all your data on a local server located physically within your business. The software is installed directly onto your POS terminals.

- Cloud-Based POS: This modern approach, also known as a Software-as-a-Service (SaaS) POS, stores your data on remote servers (“the cloud”). You access the software through the internet on your POS devices, typically by paying a monthly subscription fee.

Here is a detailed comparison to help you decide which is the right POS system model for your business:

| Feature | On-Premise POS System | Cloud-Based POS System |

| Data Storage | Data is stored on a local server at your business location. | Data is stored on secure, remote servers managed by the provider. |

| Accessibility | Data can only be accessed from terminals on-site. | Data can be accessed from anywhere with an internet connection. |

| Upfront Cost | High initial investment for software licenses and server hardware. | Low upfront cost; typically a monthly or annual subscription fee. |

| Maintenance | You are responsible for all server maintenance, backups, and IT issues. | The provider handles all server maintenance, backups, and security. |

| Software Updates | Updates must be purchased and manually installed, often at a high cost. | Updates are rolled out automatically and are usually included in the subscription fee. |

| Security | You are solely responsible for data security and PCI compliance. | The provider manages data security and helps ensure PCI compliance. |

| Offline Functionality | Can typically function without an internet connection. | Many offer an offline mode that syncs data once the connection is restored. |

For most modern small to medium-sized businesses, a cloud-based solution is the right POS system due to its lower upfront cost, greater flexibility, and reduced IT burden.

The Importance of Software User-Friendliness (UI/UX)

A POS system can be packed with powerful features, but if the software is confusing and difficult to navigate, it will hinder your operations. The user interface (UI) and user experience (UX) are incredibly important. A well-designed, intuitive interface reduces the time it takes to train new employees and minimizes the chance of errors during busy periods.

When you are demoing a potential solution, pay close attention to the workflow for common tasks like processing a sale, adding a new item to inventory, or looking up a customer. A complicated interface can quickly turn what seems like a great system into the wrong choice. The right POS system should feel intuitive and make daily tasks easier, not more complex.

Integrations and Payments: Expanding Your POS Capabilities

A modern POS system should not operate in a silo. Its true power is unlocked when it serves as the central hub of your business technology, seamlessly connecting with the other tools and services you use. The ability to integrate with third-party applications and provide flexible, transparent payment processing is a critical factor in determining the right POS system for your business.

The Power of Third-Party Integrations

Integrations allow your POS system to share data with other software platforms automatically, eliminating the need for manual data entry and providing a holistic view of your business. This creates a connected ecosystem that boosts efficiency and unlocks new capabilities.

Some of the most important integrations to look for include:

- Accounting Software: An integration with platforms like QuickBooks, Xero, or Sage automatically syncs your daily sales data, simplifying bookkeeping, reducing errors, and making tax season much less stressful.

- E-commerce Platforms: If you sell online (or plan to), an integration with Shopify, BigCommerce, or WooCommerce is essential. This allows you to manage your in-store and online inventory, sales, and customer data from a single platform.

- Email Marketing Tools: Connecting your POS to services like Mailchimp or Klaviyo lets you automatically add new customers to your mailing lists and use their purchase data to send targeted, personalized marketing campaigns.

- Delivery and Ordering Services: For restaurants, integrating with platforms like Uber Eats or DoorDash streamlines the online ordering process, sending orders directly to your POS and kitchen.

The right POS system acts as a force multiplier, enhancing the value of all your business software through seamless integration.

Understanding Payment Processing

Accepting payments is the core function of any POS system, but the way those payments are processed can have a significant impact on your bottom line. You have two main options: an all-in-one system with integrated payment processing, or a system that allows you to choose your own third-party payment processor.

- Integrated Payments: The POS provider is also your payment processor. This simplifies setup and support, as you only have one company to deal with. The pricing is often a predictable flat rate per transaction.

- Third-Party Processor: You can choose your own merchant services provider. This may allow you to shop around for lower rates (like an Interchange-plus pricing model), but it can also add complexity to your setup and support.

When evaluating options, it is vital to get a clear and complete breakdown of all associated fees. The right POS system offers transparent, competitive, and easy-to-understand payment processing, without locking you into a long-term contract with hidden fees.

Ensuring Security and Compliance (PCI)

Protecting your customers’ sensitive payment card information is not just good practice; it is a requirement. The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment.

Failure to comply with PCI standards can result in hefty fines and a devastating loss of customer trust. A modern, reputable POS provider will take security very seriously. The right POS system will use technologies like end-to-end encryption and tokenization to protect card data and will help you achieve and maintain PCI compliance. Choosing a cloud-based system from an established provider often simplifies this process, as they handle much of the technical security infrastructure on your behalf. Never compromise on security when choosing your right POS system.

The Final Selection Process: How to Demo and Decide

You have analyzed your needs, explored the features, and understood the technical aspects. Now it is time to narrow down your options and make a final decision. This final phase is about hands-on testing and due diligence. A systematic approach here will ensure that you are confident in your choice and that the right POS system is truly the best fit for your business.

Researching and Shortlisting Vendors

Start by creating a shortlist of three to five promising POS providers. To build this list, you can:

- Read online reviews: Look at reputable software review sites like Capterra, G2, and Merchant Maverick. Pay attention to reviews from businesses that are similar in size and industry to yours.

- Ask for recommendations: Reach out to other business owners in your industry or local community. First-hand experiences and recommendations can be incredibly valuable.

- Create a checklist: Use the knowledge you’ve gained to create a checklist of your must-have and nice-to-have features. Compare each potential vendor against this list to see how they stack up.

This initial research will help you filter out the noise and focus your energy on the most viable candidates for the right POS system.

The Critical Role of Product Demos

Never purchase a POS system without first seeing it in action. A product demonstration is your opportunity to go beyond the marketing materials and experience the software firsthand. This is arguably the most critical step in finding the right POS system.

During the demo, do not be a passive observer. Ask the sales representative to walk you through the specific workflows that are most important to your business. For example:

- “Can you show me how I would process a return for a customer who lost their receipt?”

- “How would I add a new menu item with multiple modifiers?”

- “Walk me through the process of running a sales report for the last quarter.”

- “How intuitive is the process for adding a new employee and setting their permissions?”

Testing the system with these real-world scenarios is the ultimate test of its usability and suitability for your operations. This hands-on experience will quickly reveal whether it is the right POS system for your team.

Evaluating Customer Support and Service

Even the best software can run into issues. When problems arise—especially during a busy service period—the quality of your POS provider’s customer support becomes paramount. A great product backed by poor support is not the right POS system.

Before signing any contract, investigate the provider’s customer support:

- Availability: Is support available 24/7? If your business operates outside of standard 9-to-5 hours, this is non-negotiable.

- Support Channels: Do they offer support via phone, email, and live chat? Phone support is often crucial for urgent issues.

- Reputation: Look for reviews that specifically mention customer support experiences. Are customers happy with the response times and the quality of the help they receive?

- Onboarding and Training: What resources do they provide to help you get set up and train your staff? A smooth onboarding process is essential.

Excellent, reliable customer support provides peace of mind and is a key characteristic of the right POS system.

Conclusion: The Right POS System as a Growth Partner

Choosing a point of sale system is a decision that extends far beyond the checkout counter. It is a strategic choice that impacts your operational efficiency, customer relationships, data intelligence, and ultimately, your capacity for growth. The process requires careful consideration and thorough research, but the payoff is a system that works for you, not against you.

By first understanding your unique business needs, then meticulously evaluating core features, hardware, software, integrations, and customer support, you can move forward with confidence. Remember that the goal is not just to find a POS system, but to find the right POS system—a solution that aligns with your current operations and your future vision.

View this decision as an investment in a long-term business partner. The right POS system will streamline your daily tasks, empower your staff, delight your customers, and provide the critical insights you need to make smarter, data-driven decisions. It is a foundational tool that, when chosen correctly, will not only support your business but actively help it to thrive and succeed in the years to come. Your commitment to finding the right POS system is a direct investment in the future of your business.

Also Read: The Future of Payments: Trends Every Merchant Should Watch

Frequently Asked Questions (FAQ)

1. What is the main difference between a cloud-based and an on-premise POS system?

The primary difference lies in where your business data is stored and how you access the software. An on-premise system stores all data on a local server at your business location, requiring a large upfront investment and self-managed IT. A cloud-based system stores your data on the provider’s secure remote servers, which you access via the internet for a monthly subscription fee, offering greater flexibility, lower initial costs, and automatic updates.

2. How much should I expect to pay for a POS system?

Costs can vary widely. For a modern cloud-based POS system, expect a monthly software subscription ranging from $50 to $300+ per terminal, depending on the features and provider. Hardware costs can range from a few hundred dollars (if using an existing iPad) to several thousand for a complete, multi-terminal setup. You must also factor in payment processing fees, which are typically a small percentage of each transaction.

3. Can I use my own iPad or tablet with a POS system?

Yes, many of today’s leading POS providers offer software that is designed to run on common consumer devices like iPads or Android tablets. This can significantly lower your initial hardware costs. However, you must always confirm that your specific device model is fully compatible with the POS software and any associated hardware (like card readers and printers) before you commit.

4. What is PCI compliance and why is it important for my POS system?

PCI (Payment Card Industry) compliance is a set of security standards required for any business that processes credit card transactions. It is crucial for protecting your customers’ sensitive card data from theft and fraud. Choosing a POS provider that is PCI compliant is essential, as they will provide the secure technology (like encryption and tokenization) needed to protect both your business and your customers. Non-compliance can lead to severe financial penalties.

5. How do I know if a POS system is scalable for my growing business?

A scalable POS system should make it easy and affordable to grow. Look for a cloud-based system that allows you to easily add new terminals, employees, or even new business locations without a massive overhaul. It should also have a robust feature set and integration capabilities (like e-commerce and multi-location management) that you can activate as your business needs evolve. Inquiring about their pricing tiers for larger businesses will also give you an idea of its scalability. This is a key part of choosing the right POS system for the long term.